Clean Label Products Market Size to Worth USD 712.48 Billion by 2034 | Towards FnB

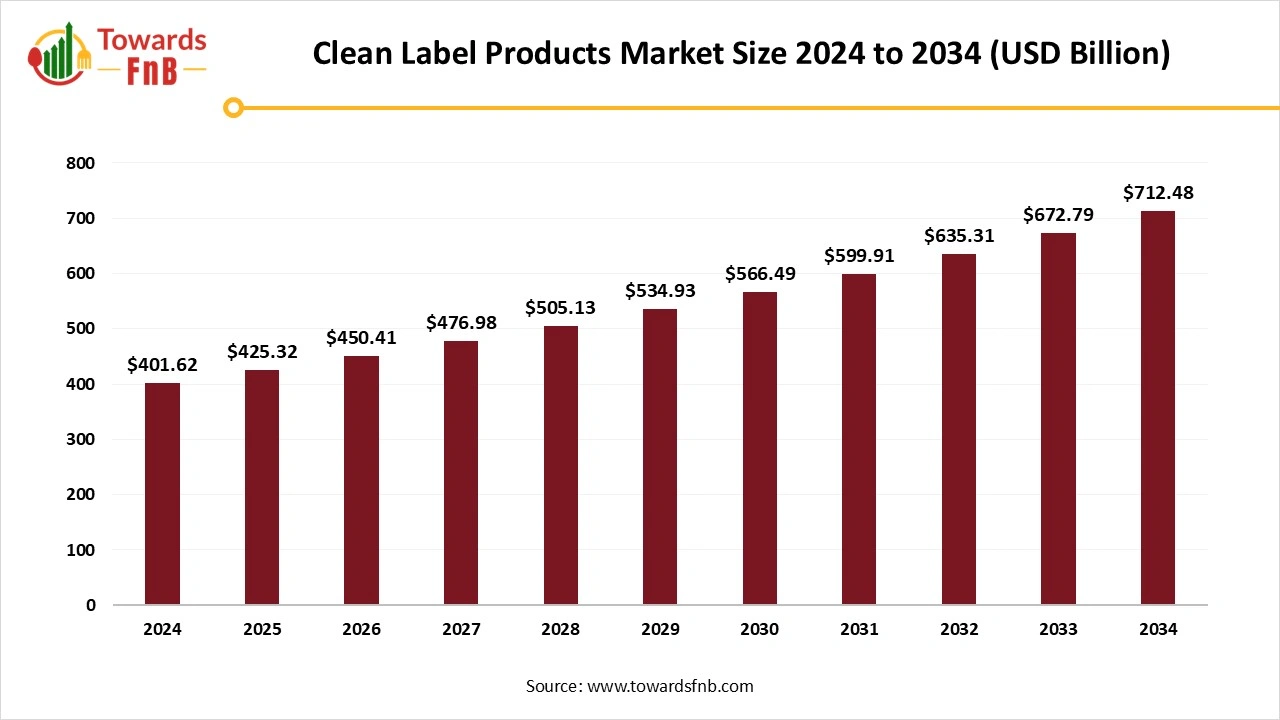

According to Towards FnB, the global clean label products market size is calculated at USD 425.32 billion in 2025 and is expected to reach USD 712.48 billion by 2034, reflecting at a CAGR of 5.9% from 2025 to 2034. This growth trajectory underscores the strong consumer transition toward ingredient transparency and natural product formulations across multiple industries, including food and beverage, personal care, and pharmaceuticals.

Ottawa, Nov. 13, 2025 (GLOBE NEWSWIRE) -- The global clean label products market size stood at USD 401.62 billion in 2024 and is predicted to increase from USD 425.32 billion in 2025 to reach nearly USD 712.48 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The growing health consciousness, higher demand for clean, organic, and natural nutrition, and increasing awareness of the importance of natural flavors and ingredients are some of the major factors driving the market's growth in recent times.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5747

Key Highlights of the Clean Label Products Market

- By region, Europe dominated the clean label products market with a 32% share in 2024, whereas the Asia Pacific region is expected to experience the fastest growth during the forecast period.

- By product, the food & beverage segment held a dominant share of 70% in 2024, whereas the personal care & cosmetics segment is projected to grow at a robust CAGR between 2025 and 2034.

- By ingredient, clean label colors led the market with a 25% share in 2024, whereas the clean label sweeteners are expected to grow at a strong CAGR between 2025 and 2034.

- By form, the powder segment dominated the market with a 40% share in 2024, whereas the liquid segment is expected to grow the fastest during the forecast period.

- By application, the food processing segment accounted for 50% of the market share in 2024, whereas the nutraceuticals segment is anticipated to grow rapidly.

- By distribution channel, supermarkets and hypermarkets held the largest market share at 35% in 2024, whereas the online retail segment is expected to grow at a faster pace due to the increasing integration of internet shopping and e-commerce penetration.

Higher Demand for Clean-Label Options Is Helpful for the Growth of the Clean-Label Products Industry

Higher demand for transparent, healthier, and organic food options is a major factor driving the growth of the clean-label products market. Products made from cleaner, organic, sustainable, and natural ingredients are in high demand among consumers lately due to their multiple health benefits. Hence, clean-label food and beverages, personal care and cosmetic products, and products from other domains are highly demanded by consumers compared to those made from artificial ingredients. Such factors help to fuel the growth of the market and allow consumers to maintain their nutritional profile and consume only natural and organic options.

Impact of AI in the Clean Label Products Market

Artificial intelligence (AI) is transforming the clean label products market by accelerating innovation, improving transparency, and enhancing operational efficiency across the food and beverages industry. AI-powered algorithms analyze large datasets on ingredient functionality, nutritional value, and consumer preferences to identify natural alternatives to synthetic additives, preservatives, and flavorings. Machine learning models simulate ingredient interactions to optimize texture, taste, and shelf life in clean label formulations, reducing the need for chemical stabilizers while maintaining product quality. This allows manufacturers to create natural, minimally processed products that align with rising consumer demand for authenticity and health-conscious choices.

AI-driven predictive analytics optimize mixing, processing, and packaging conditions, ensuring consistency, reducing waste, and improving energy efficiency. Computer vision systems monitor ingredient purity, detect contamination, and ensure accurate labeling in real time, supporting compliance with food safety and transparency standards. AI also plays a critical role in supply chain traceability, helping track ingredient origins, sustainability certifications, and production practices to build consumer trust and meet regulatory requirements.

Recent Developments in the Clean Label Products Market

- In May 2025, Revant Himatsingka, recognized as Food Pharmer on social media, is set to launch his brand titled ‘OWN- Only What’s Needed’. The clean-label food brand is set to launch its first product, a whey supplement, with a soft launch in June and wider rollout in July. (Source- https://www.buzzincontent.com)

- In July 2025, Khetike, a Mumbai-based healthy food startup, raised USD 18 million in a funding round. The round was led by Narotam Sekhsaria Family Office and Anicut Capital. The brand aims to expand itself in the Middle East, Europe, and the US. (Source- https://waya.media)

New Trends of Clean Label Products Market

- Higher demand for specific claims such as ‘no-additives and preservatives’, ‘natural’, and ‘non-GMO’ products helps to enhance the growth of the market.

- Higher demand for brands following sustainable practices for providing clean-label products is another major trend and factor for the growth of the market.

- Higher demand for products with minimum processing and made by following minimum processing is also highly demanded, fueling the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/clean-label-products-market

Trade Analysis of the Clean Label Products Market

North America: United States and Canada

- The United States remains the largest market for clean label products, driven by consumers seeking transparency, natural ingredients, and minimal processing. According to NielsenIQ and Innova Market Insights, over 60 percent of U.S. consumers actively check product ingredient lists before purchase.

- The clean label movement has integrated deeply into packaged food, snacks, and beverages, creating demand for imported natural colors, stabilizers, and sweeteners from Asia and Latin America. The U.S. food retail and consumer packaged goods market, valued at over 2 trillion dollars, offers strong growth for clean label claims.

- For trade players: focus on compliant ingredient documentation such as non-GMO and natural origin certifications, clean label reformulation consultancy, and small-batch import models that cater to artisanal and health-focused brands.

Europe: Western and Northern Europe

- Europe remains the global benchmark for clean label standards, with the EU’s Food Information to Consumers (FIC) regulation enforcing detailed ingredient transparency. Western Europe shows strong maturity in clean label categories, while Northern Europe drives innovation in organic and additive-free products.

- Growth in the region is steady but driven more by product reformulation than new launches. Local ingredient suppliers in France, Germany, and the Netherlands have started exporting clean label starches, plant-based texturizers, and natural preservatives globally.

- Trade advice: all import consignments should carry complete traceability records, allergen information, and third-party certifications such as BRCGS or IFS to facilitate entry into EU distribution networks. Multilingual packaging remains essential for retail integration.

Asia Pacific: China, India, Japan, ASEAN

- Asia Pacific has become both a production hub and an emerging consumer base for clean label products. Rising middle-class incomes and growing health awareness have accelerated the shift toward minimally processed, additive-free foods in countries like China and India.

- China’s e-commerce-driven food trade and Japan’s regulatory support for natural additives make the region a growing importer and exporter simultaneously. India and ASEAN nations serve as suppliers of natural ingredients such as herbal extracts, native starches, and fruit concentrates to North American and European manufacturers.

- Trade focus: invest in clean label ingredient processing zones with export certification, strengthen quality traceability, and adapt packaging for both bulk B2B exports and retail-ready SKUs tailored to regional e-commerce growth.

Latin America: Brazil, Mexico, Others

- Latin America’s clean label market is still developing but shows notable progress in Brazil, Chile, and Mexico. Consumers are shifting toward natural sweeteners and preservative-free foods, particularly in beverages and bakery applications.

- Regional supply advantages, such as tropical fruit bases, cocoa, and natural flavoring sources, support exports of raw materials for clean label formulation. However, higher logistics costs and fragmented distribution remain constraints.

- Strategy: exporters should position offerings through regional distributors with established retail and foodservice networks. Pricing flexibility and localized labeling in Portuguese and Spanish can improve penetration in mid-market product tiers.

Middle East and Africa

- Clean label adoption in the GCC region is growing within premium product categories, particularly in the UAE and Saudi Arabia, where consumers associate natural and organic claims with product quality and safety. Imports mainly consist of packaged foods and beverages from Europe and North America.

- In Sub-Saharan Africa, the clean label trend is nascent but gradually building, supported by urban retail expansion and rising disposable incomes among younger consumers.

- Logistic recommendation: consolidate shipments through GCC trade hubs to serve broader MEA markets, utilize bonded warehousing for re-export flexibility, and partner with local distributors to navigate halal certification and label translation requirements.

Product Survey: Global Clean Label Products Market

| Product Category | Description / Function | Common Clean Label Attributes | Key Applications / End-Use Sectors | Leading Brands / Producers |

| Clean Label Bakery Products | Baked goods formulated without artificial additives, preservatives, or synthetic colors. | Natural emulsifiers, enzyme-based improvers, non-GMO flours, natural flavors | Bread, cookies, cakes, muffins | Grupo Bimbo, Mondelez, General Mills, Warburtons |

| Clean Label Dairy & Non-Dairy Alternatives | Dairy and plant-based beverages free from synthetic stabilizers, gums, or artificial sweeteners. | Natural thickeners (pectin, guar gum), minimal processing, organic certification | Milk, yogurt, plant-based milks, cheese | Danone, Chobani, Oatly, Amul |

| Clean Label Snacks | Snacks made from whole or minimally processed ingredients, with natural seasoning and no artificial flavoring. | No preservatives, non-GMO, baked not fried, natural colorants | Chips, popcorn, nuts, trail mixes | KIND Snacks, Bare Snacks, Hippeas, General Mills |

| Clean Label Beverages | Functional and refreshment drinks with natural flavorings and minimal processing. | No artificial sweeteners or colors, non-GMO, transparent ingredient sourcing | Juices, teas, kombucha, plant-based protein drinks | PepsiCo (Tropicana Pure), Coca-Cola (Honest Tea), Suja, Innocent Drinks |

| Clean Label Processed Meat & Seafood | Meat and fish products made using natural preservatives and clean curing alternatives. | Natural nitrite sources (celery powder), vinegar, fermented extracts | Sausages, deli meats, marinated products | Hormel Natural Choice, Applegate, Maple Leaf Foods |

| Clean Label Sauces, Dressings & Condiments | Free from synthetic emulsifiers, colorants, and stabilizers; made with natural ingredients. | Natural acids (lemon juice, vinegar), native starches, spice extracts | Ketchup, mayonnaise, salad dressings, dips | Hellmann’s (Real line), Primal Kitchen, Annie’s Naturals |

| Clean Label Confectionery | Candy and sweets with reduced additives and artificial colorants, using natural flavors and color sources. | Fruit extracts, beet/paprika colorants, no HFCS | Gummies, chocolates, energy bars | Nestlé (Simply Good), SmartSweets, Unreal Snacks |

| Clean Label Baby & Infant Foods | Nutrient-rich baby foods with traceable ingredients, no preservatives or artificial additives. | Organic ingredients, minimal heat processing, non-GMO | Baby cereals, pouches, snacks | Gerber Organic, Happy Family Organics, Little Spoon |

| Clean Label Frozen Foods | Frozen meals and ready-to-eat products made with simple, natural ingredients. | Preservative-free, minimal sodium, steam-cooked vegetables | Ready meals, frozen snacks, pizzas | Amy’s Kitchen, Conagra (Healthy Choice), Nestlé (Lean Cuisine Balance) |

| Clean Label Pet Food | Pet foods formulated without artificial colors, preservatives, or fillers. | Whole protein sources, natural vitamins, no rendered meats | Dry and wet pet food | Blue Buffalo, Wellness Core, Open Farm |

| Clean Label Flavors, Colors & Ingredients | Naturally sourced additives replacing synthetic versions in food manufacturing. | Beetroot red, turmeric yellow, spirulina blue, natural vanilla | All processed food categories | ADM, Kerry Group, Givaudan, Sensient, Symrise |

| Clean Label Bakery & Culinary Ingredients | Natural functional ingredients replacing artificial emulsifiers, stabilizers, and improvers. | Enzymes, citrus fiber, native starch, fruit pectin | Baking mixes, sauces, soups, gravies | Tate & Lyle, Ingredion, Corbion, Cargill |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5747

Clean Label Products Market Dynamics

What Are the Drivers of the Clean Label Products Market?

Factors such as high demand for clean label products, ingredients, organic options, plant-based food and beverages, help to fuel the growth of the market. Growing consumer awareness regarding the importance of organic, nutritional, and clean-label products for the smooth functioning of the human body is another major factor for the growth of the market. Use of clean label products in different domains such as food and beverages, nutraceuticals and pharmaceuticals, cosmetic and personal care products, and various other domains helps to fuel the growth of the clean label products market.

Challenge

Supply Chain Issues Obstructing the Market’s Growth

Issues in the supply chain, such as natural disasters, geopolitical issues, and potential fluctuation in costs, are some of the major issues observed in the growth of the market. Such issues may disrupt the supply of clean-label products to distributors and suppliers, which hampers the supply chain, affecting the growth of the market. Hence, it may also hamper the consumer trust in the brand, further affecting the market’s growth.

Opportunity

Technological Advancements are Helpful for the Market’s Growth

One of the major opportunities for the growth of the market involves technological advancements in novel processing. Advanced technologies allow manufacturers to produce cleaner, sustainable, and safer products, which is helpful for the growth of the market. Such advancements also allow manufacturers to meet the changing needs of health-conscious consumers, further fueling the growth of the market. Hence, it allows such consumers to get a variety of options of clean-label products easily in the market, further fueling its growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Clean Label Products Market Regional Analysis

Europe Dominated the Clean Label Products Market in 2024

Europe dominated the clean label products market in 2024 due to high demand for clean label products and ingredients in the region. Consumer awareness regarding the importance of clean-label products for a healthy body is another major factor for the growth of the market in the region. Hence, the manufacturers of different domains in the region specify the use of clean-label ingredients, fueling the growth of the market in the region. Countries such as Germany and France have a major contribution to the growth of the market in the region due to the high demand for clean-label products in the region.

Asia Pacific is Observed to be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is observed to be the fastest growing region in the foreseen period due to high demand for clean label products and ingredients helpful for the growth of the market. Growing consumer awareness for clean label products, higher consumption of organic and health food and beverage options, and higher adoption of natural and clean diets further fuel the growth of the market. Countries such as India, China, Japan, and South Korea have a major contribution to the growth of the market. India is ranked 3rd globally with maximum clean-label product launches, further fueling the growth of the market in the foreseeable period.

North America Is Expected to Grow With Notable Growth in the Foreseeable Period

North America is observed to have a notable growth in the foreseen period due to high demand for transparency in the use of ingredients and products, high demand for clean-label food and beverage options, and higher adoption of cleaner diets. Such factors help to fuel the growth of the market in the region. Consumer awareness regarding the importance of organic and plant-based options for a healthier nutritional profile is another major factor for the growth of the market. Countries such as the US, Canada, and Mexico have made major contributions to the growth of the market due to growing consumer awareness.

Clean Label Products Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.9% |

| Market Size in 2025 | USD 425.32 Billion |

| Market Size in 2026 | USD 450.41 Billion |

| Market Size by 2034 | USD 712.48 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Clean Label Products Food Market Segmental Analysis

Product Analysis

The food and beverages segment led the clean label products market in 2024 due to factors such as high demand for clean, organic, and functional food options. The market is also observed to grow due to growing awareness of organic and healthy food options to maintain the healthy functioning of the human body. Use of additives, preservatives, artificial colors, and other similar ingredients hampers the human body and damages it severely if consumed for a long time. Hence, the segment is observed to grow lately due to higher demand for clean label products and nutritional food and beverage options by consumers of different age groups.

The personal care and cosmetics segment is expected to grow in the foreseeable period due to the multiple benefits of using such products for the skin. Cosmetics and personal care products made from eco-friendly methods, natural ingredients, and vegan ingredients help to enhance the skin quality, maintain moisturization, lower the appearance of wrinkles and dark spots, and also help to boost the collagen levels for a youthful appearance. Hence, such products are highly demanded in the market compared to those using harmful chemicals that may damage the skin quality. Hence, the segment is observed to grow in the foreseen period and contribute to the growth of the market.

Ingredient Analysis

The clean label colors segment dominated the clean label products market in 2024 due to consumer awareness regarding the importance of clean-label food and beverages utilizing clean label food colors. They help to enhance the appearance of the food and beverage options, along with enhancing their taste. Such colors are organic and made from clean ingredients, and hence are essential for the growth of the human body as well. Hence, the segment has a major contribution to the growth of the market.

The clean label sweeteners segment is expected to grow in the foreseen period due to high demand for clean label products utilizing natural forms of sweeteners and cutting the use of refined sugar. Health-conscious consumers form a huge base for the market, as such consumers are always in search of clean-label products that use healthy ingredients to maintain their nutritional profile. Hence, brands today pay attention to consumer requirements and are adopting the use of natural sweeteners such as maple syrup, honey, stevia, monk fruit sugar, and other healthy alternatives. Hence, the segment has a major contribution to the growth of the market in the foreseeable period.

Form Analysis

The powder segment dominated the clean label products market in 2024 due to its multiple benefits, such as ease of storage, ease of handling, and ease of blending powdered clean ingredients in various food and beverage options. Such factors help to support the market’s growth. Powdered ingredients also have a longer shelf life, further fueling the growth of the market. Hence, such ingredients are highly utilized for the manufacturing of dietary supplements and various nutraceuticals.

The liquid segment is expected to grow in the forecast period due to the ease of its incorporation, which is helpful to enhance the nutritional profile of clean-label food and beverages. Such products are made from natural and healthy ingredients to maintain the overall functioning of the body, along with a smooth digestion process. The segment also enhances the importance of the usage of clean-label liquid ingredients for the pharmaceutical and nutraceutical industry, further enhancing the growth of the market.

Distribution Channel Analysis

The supermarkets and hypermarkets segment led the clean label products market in 2024 due to high consumer preference for shopping from offline stores. The market is also observed to grow due to the easy availability of such stores near residential areas, allowing consumers to shop for the required products along with other innovative products available in such markets. Such stores have separate sections for different types of products, allowing consumers to try different products with their detailed information.

The online retail segment is expected to grow in the foreseeable period due to the convenience offered by various e-commerce platforms. Such platforms have a huge variety of products available at affordable prices, allowing consumers to shop smartly. They also have detailed information and reviews about products that are helpful for consumers while shopping for a variety of new products. The segment also helps to enhance the market’s growth with the help of easy availability of products to consumers within minutes, at the ease of being at home.

Application Analysis

The food processing segment dominated the clean label products market in 2024 due to the importance of clean label food and beverage options for a healthier system. The segment focuses on the use of clean-label ingredients for the manufacturing of various food and beverage options, which are helpful for the growth of the market. Such options are helpful for the smooth functioning of the body and also help to keep one protected from various diseases that can happen due to polluted food. Hence, the segment has a major contribution to the growth of the market.

The nutraceuticals segment is expected to grow in the foreseeable period due to high consumption of such products by health-conscious consumers. Such nutraceutical products are rich in nutrients and allow consumers to maintain their nutritional profile. Hence, the segment has a major contribution to the growth of the market. Nutraceutical suppliers involve pre-formulated and pre-processed products that help lower the energy and wastage of resources. Hence, the segment is expected to grow in the foreseen period, which is helpful for the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Clean Label Products Market

- Nestlé S.A. – Nestlé focuses on reformulating its vast product portfolio to remove artificial additives, flavors, and preservatives, prioritizing natural ingredients and clean-label transparency. The company’s clean-label initiatives span across dairy, beverages, snacks, and infant nutrition, aligning with consumer demand for minimally processed foods.

- Unilever PLC – Unilever promotes clean-label innovation across its food and beverage brands by emphasizing natural sourcing, reduced additives, and traceable supply chains. Brands like Hellmann’s and Knorr highlight simple, recognizable ingredients and sustainability-driven product development.

- The Kraft Heinz Company – Kraft Heinz is expanding its clean-label portfolio through simplified ingredient lists, non-GMO sourcing, and preservative-free recipes. The company’s focus includes condiments, sauces, and meal solutions, aligning with the “real food” movement among global consumers.

- General Mills, Inc. – General Mills has reformulated several brands to meet clean-label standards by eliminating artificial colors, flavors, and preservatives. Its portfolio, including Annie’s, Cascadian Farm, and Nature Valley, centers on sourcing organic and natural ingredients.

- The Kellogg Company – Kellogg emphasizes clean-label reformulation across its cereals, snacks, and plant-based foods, reducing artificial additives and improving nutritional transparency. The company is committed to using sustainable, recognizable ingredients to meet evolving consumer preferences.

- Danone S.A. – Danone is a pioneer in clean-label dairy and plant-based foods, prioritizing short ingredient lists and natural fermentation processes. Brands like Activia, Alpro, and Silk reflect the company’s focus on transparency and functional nutrition.

- PepsiCo, Inc. – PepsiCo’s clean-label strategy centers on reducing artificial ingredients and expanding natural beverage and snack offerings. Its brands, including Naked Juice, Sabra, and Off the Eaten Path, highlight non-GMO, preservative-free, and sustainably sourced ingredients.

- The Coca-Cola Company – Coca-Cola invests in low-calorie, naturally sweetened, and additive-free beverages to expand its clean-label portfolio. The company’s innovations focus on natural flavors, minimal processing, and health-forward hydration solutions across global markets.

- Mondelez International, Inc. – Mondelez is simplifying ingredient lists across its global brands and emphasizing natural flavorings and reduced artificial additives. Its clean-label strategy includes reformulating snacks, biscuits, and confectionery to meet transparency and wellness trends.

- Hormel Foods Corporation – Hormel is advancing clean-label initiatives by producing minimally processed meat and protein-based foods under brands like Applegate and Natural Choice. The company prioritizes antibiotic-free and preservative-free production to align with consumer health expectations.

- Conagra Brands, Inc. – Conagra focuses on clean, natural, and preservative-free reformulations across its frozen and packaged food brands. Through lines like Healthy Choice and Evol, the company emphasizes simplified labeling and functional ingredient sourcing.

- Hain Celestial Group, Inc. – Hain Celestial specializes in organic and natural clean-label products, offering a broad portfolio across snacks, dairy alternatives, and personal care. The company’s brands like Terra Chips and Earth’s Best highlight transparency and sustainability in sourcing and labeling.

- Amy’s Kitchen Inc. – Amy’s Kitchen produces organic, vegetarian, and non-GMO frozen and packaged foods, leading in clean-label ready meals. The company avoids artificial additives and focuses on simple, wholesome ingredients to serve the health-conscious consumer base.

- Dean Foods Company – Dean Foods emphasizes minimally processed dairy products free from artificial preservatives and growth hormones. Its clean-label strategy includes promoting natural dairy and plant-based beverages that meet modern nutritional expectations.

- Maple Leaf Foods Inc. – Maple Leaf Foods drives its clean-label agenda through its “Real Food” commitment, ensuring no artificial flavors, colors, or preservatives across its meat and plant-based lines. The company leads North America in clean protein innovation and transparency.

- Arla Foods – Arla Foods, a major European dairy cooperative, focuses on natural and simple dairy products with short ingredient lists. Its clean-label approach emphasizes traceable sourcing, no artificial additives, and strong sustainability commitments across all operations.

- The Simply Good Foods Company – The company offers high-protein, low-sugar snack and nutrition products with transparent labeling and natural ingredients. Its brands like Atkins and Quest align with the clean-label trend toward balanced nutrition and health optimization.

- Müller Group – Müller develops clean-label dairy and yogurt products with an emphasis on natural flavorings and reduced additives. The company’s strategy focuses on short ingredient lists and local sourcing to appeal to European consumers seeking authenticity.

- Noosa Yoghurt, LLC – Noosa produces whole milk yogurt made with natural ingredients, real fruit, and no artificial flavors or preservatives. The brand highlights authenticity and small-batch production, aligning with the premium clean-label dairy category.

- Chobani, LLC – Chobani is a leading U.S. clean-label brand known for its Greek yogurt, oat milk, and natural beverages. The company promotes non-GMO, simple ingredients, and transparency, positioning itself as a pioneer in natural and health-oriented dairy alternatives.

Segments Covered in the Report

By Product Type

- Food & Beverages

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Snacks & Cereals

- Beverages (Non-Alcoholic)

- Sauces, Dressings & Condiments

- Meat & Meat Alternatives

- Ready-to-Eat Meals

- Baby Food

- Personal Care & Cosmetics

- Skin Care

- Hair Care

- Oral Care

- Household Products

- Cleaners & Detergents

- Dishwashing Products

- Air Fresheners

By Ingredient Type

- Clean Label Flavors

- Clean Label Colors

- Clean Label Preservatives

- Clean Label Emulsifiers

- Clean Label Sweeteners

- Clean Label Stabilizers

- Clean Label Thickeners

- Clean Label Enzymes

By Form

- Powder

- Liquid

- Granules

- Paste

By Distribution Channel

- Supermarkets & Hypermarkets

- Natural & Organic Stores

- Convenience Stores

- Online Retail

- Specialty Health Stores

- Pharmacy & Drug Stores

By Application

- Food Processing

- Beverage Manufacturing

- Cosmetics & Personal Care Manufacturing

- Nutraceuticals

- Household Care

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5747

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.